For Canadian travelers seeking to maximize their rewards without incurring an annual fee, finding the right travel credit card can make all the difference. With various options available, it’s essential to compare and evaluate each card’s benefits, rewards rates, and redemption options. This article will guide you through the best no-annual-fee travel credit cards in Canada, helping you make an informed decision and get the most out of your travel experiences.

Best Travel Credit Cards with No Annual Fee in Canada 2023

- MBNA Rewards Platinum Plus Mastercard

Annual Fee: $0 Rewards Rate: Up to 2 MBNA Rewards points per $1 spent

The MBNA Rewards Platinum Plus Mastercard is an excellent no-annual-fee travel credit card for those looking to earn flexible rewards points. Cardholders can earn 2 MBNA Rewards points per $1 spent on eligible grocery, dining, and digital media purchases (up to $5,000 spent annually in each category), and 1 point per $1 spent on all other purchases.

MBNA Rewards points can be redeemed for travel, merchandise, gift cards, or statement credits, offering versatile redemption options. The card also includes travel benefits such as common carrier accident insurance and rental car collision damage waiver, providing added peace of mind during your travels.

- Tangerine World Mastercard

Annual Fee: $0 Rewards Rate: Up to 2% cashback

The Tangerine World Mastercard is not only a great cashback card but also a valuable option for travelers seeking a no-annual-fee credit card. Cardholders can earn 2% cashback in two categories of their choice, such as groceries, gas, or hotel accommodations, and 0.5% cashback on all other purchases. Additionally, cardholders can unlock a third 2% cashback category when they deposit their cashback directly into a Tangerine Savings Account.

While this card doesn’t offer travel-specific rewards, the cashback earned can be used to offset travel expenses. The Tangerine World Mastercard also includes rental car insurance and mobile device insurance, providing extra protection during your adventures.

- Home Trust Preferred Visa

Annual Fee: $0 Rewards Rate: 1% cashback on all purchases

The Home Trust Preferred Visa is a simple, no-annual-fee travel credit card that offers valuable perks for frequent travelers. Cardholders can earn 1% cashback on all purchases, with no limits on cashback earnings. While this card doesn’t have a robust rewards program, its standout feature is the lack of foreign transaction fees, saving you 2.5% to 3% on foreign currency purchases made while traveling.

The card also includes complementary rental car collision and loss damage insurance, adding extra value for travelers who frequently rent vehicles during their trips.

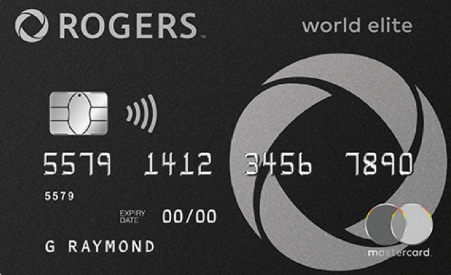

- Rogers World Elite Mastercard

Annual Fee: $0 Rewards Rate: Up to 3% cashback

Although not specifically a travel rewards card, the Rogers World Elite Mastercard offers attractive cashback rates that can be used to offset travel expenses. Cardholders earn 3% cashback on eligible purchases made in a foreign currency, 1.5% cashback on eligible Canadian purchases, and 0.5% cashback on all other purchases. The cashback earned can be applied towards travel expenses, such as flights, hotels, and car rentals.

The card also includes travel insurance benefits, such as emergency medical coverage, trip interruption and cancellation insurance, and rental car collision and loss damage insurance, providing added protection for your travels.

Conclusion

For Canadian travelers seeking to earn rewards without the burden of an annual fee, the travel credit cards listed in this guide offer a variety of benefits, rewards rates, and valuable perks. By carefully evaluating each card’s features and aligning them with your travel preferences and spending habits, you can maximize your rewards and enjoy cost-effective travel experiences.

When selecting a no-annual-fee travel credit card, consider factors such as foreign transaction fees, cashback or rewards points earning rates, travel insurance coverage, and redemption options. By doing so, you can find a card that not only saves you money on fees but also enhances your travel experiences through valuable rewards and benefits.

It’s important to remember that using a travel credit card responsibly and paying off your balance in full each month is crucial for maintaining a healthy credit score and avoiding interest charges. With the right travel credit card and responsible usage, you can make the most of your adventures without breaking the bank.