(Bloomberg) — Walmart Inc. sold its stake in Chinese e-commerce giant JD.com Inc. to raise about $3.6 billion.

Most Read from Bloomberg

The U.S. retailer sold 144.5 million shares at $24.95 each, according to people familiar with the matter, who asked not to be identified because the information is private. The stock is off 11% by Tuesday’s close in the U.S., according to Bloomberg calculations, and near the low end of the $24.85 to $25.85 price range.

JD.com’s Hong Kong-listed shares fell 11% at the open on Wednesday, leading to a broader sell-off in Chinese e-commerce and technology stocks. Walmart is refining its strategy in the world’s second-largest economy, where its longtime e-commerce partner is battling traditional rivals Alibaba Group Holding Ltd and Demu-owner PDD Holdings Inc.

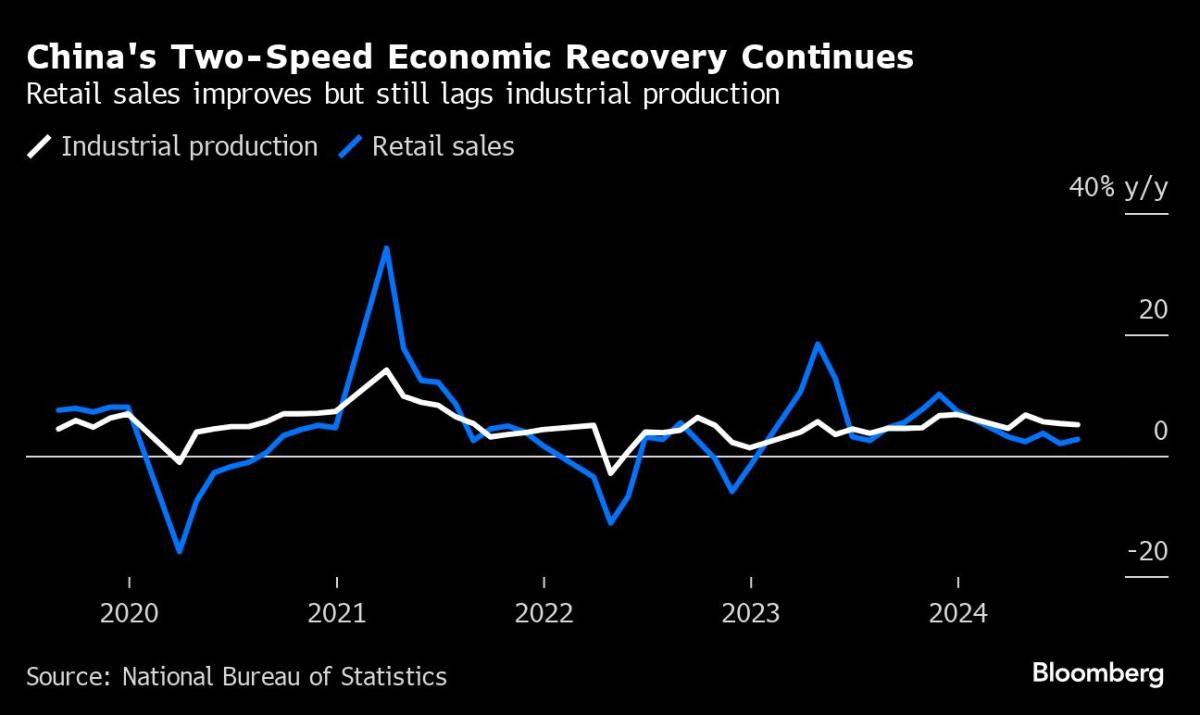

The U.S. company has built a mature e-commerce and delivery system in China for both Sam’s Club and its hypermarket business and is focusing on its own offerings, a person familiar with the matter said, speaking on condition of anonymity. The deal comes as the asset crisis, market volatility and uncertain job prospects continue to weigh on Chinese consumption.

“I expect Walmart to be disappointed with the horse they backed,” said Mark Tanner, managing director of marketing firm China Skinny. “It doesn’t feel as though the original ambitions were too constrained as planned during the acquisition.”

Morgan Stanley, the broker-dealer handling the offering, is familiar with the situation. JD.com bought back $390 million in its stock today.

Representatives for Walmart, JD.com and Morgan Stanley did not immediately respond to requests for comment from Bloomberg. Walmart said the decision to reduce its stake will allow it to focus on its own businesses in China and allocate funds to other priorities, Gailian reported Wednesday.

According to the China Chain Store & Franchise Association, Walmart’s Sam’s Club franchise has been a bright spot for the company, the only hypermarket chain to post sales growth among the top 5 players last year. In China, the unit offers premium products with a membership model that is now being copied by rivals, while the company’s other core hypermarkets struggle alongside rivals.

Meanwhile, China’s biggest Internet companies are trying to reverse the decline as economic uncertainty and consumers’ changing shopping habits weigh on revenues. Last week, Alibaba — long a barometer for the industry — surprised investors when it revealed that its core commerce business actually shrunk in the June quarter.

JD.com’s June-quarter results beat expectations – even though revenue grew just 1.2%. It extended its string of single-digit quarters through 2022, a period of ill health that has halved its market value since the start of last year.

The Walmart-JD breakup follows a pattern of online and offline retailers dissolving their partnerships because earlier ambitions to seamlessly merge physical and online consumer experiences have not materialized. Earlier this year, Bloomberg reported that Alibaba was considering a sale of its Intime department store division.

The stake sale marks the end of a partnership between the two companies that began in 2016 when Walmart bought a 5% stake in the Chinese company.

The deal involved JD.com’s takeover of Walmart’s Yihaodian online marketplace, which focused on selling groceries to high-end female shoppers in major Chinese cities, the companies said at the time. Later that year, Walmart increased its stake in JD.com to 10.8%.

–With assistance from Edwin Chan.

(Updates with selling price of shares in second column)

Most read from Bloomberg Businessweek

©2024 Bloomberg LP